Where Generative AI Meets Healthcare: Updating The Healthcare AI Landscape

Authors: Justin Norden, Jon Wang, and Ambar Bhattacharyya

Intro

Over the past few years, we have witnessed a gradual yet definitive progression in artificial intelligence (AI) capabilities, now stretching beyond image recognition to natural language understanding with generative AI technologies. These systems have not merely leveled up to human performance on numerous benchmarks, but astonishingly surpassed it (90th percentile on the Bar Exam, 99th percentile on the Biology Olympiad), instigating a watershed moment in technological evolution.

Generative AI, for those new to the term, stands apart from other AI varieties due to its ability to produce new content, ranging from text and images to audio and video. It accomplishes this by learning from existing data and then utilizing that data to generate outputs that bear a resemblance to the original data. In contrast to traditional AI, generative AI could be employed for creating novel art, writing, data, music, and more.

Naturally, there are many applications of this technology in healthcare. However, despite the massive opportunity, healthcare is slow to adopt new technology. Recent data from YCombinator shows an under-representation of generative AI startups in the healthcare sector in their most recent batch. This is in sharp contrast to the vast opportunities and urgent need for efficiency improvements in the industry, as prices for hospital services continue to rise at a faster rate than in any other area.

This analysis focuses on generative AI startups in healthcare, highlighting their innovations, challenges, and market potential. We aim to familiarize founders, operators, and investors with the field, identify potential opportunities, and foster ideas for creating a better healthcare system.

Why Now is the Time to Build in Healthcare AI

In the last ten years, we've seen incredible progress in algorithms, data access, and computing power. This led to a defining moment with the launch of ChatGPT, the fastest growing app ever, capturing the fascination of creators and users worldwide. Generative AI tools and resources are increasingly available, making this exciting field accessible to many people for the first time.

In healthcare, Generative AI has ushered in a host of impressive capabilities, revolutionizing how we undertake various tasks. These range from content and code generation, to summarization, semantic search, and chatbot functionality. The ramifications for healthcare are monumental, enabling the conversion of unstructured to structured data, refining medical text summarization, enabling synthetic data creation, enhancing image processing, streamlining transcription services, and even writing medical texts. These innovations are reconstructing the healthcare landscape, signaling a future of heightened efficiency and superior patient care.

The Healthcare Opportunity

Despite being a $4 trillion market opportunity, the healthcare industry has traditionally exhibited a resistance towards technology adoption. Healthcare is an industry that still relies today on fax machines as a primary means of communication and previous technology “transformations” have paradoxically increased provider burdens and diminished their efficiency. Today however, change is happening, spurred on by the pandemic's fallout, labor shortages, cultural shifts towards technology, and new regulatory standards have created opportunities for startups to break in.

The COVID-19 pandemic expedited the integration of digital health solutions such as telemedicine, remote care, and AI into mainstream healthcare. Telemedicine use grew by 10-15x for numerous patient populations, and nearly all providers have used the technology now. As a result, investment in digital health reached a record high of $29 billion in 2021, with both providers and consumers acknowledging the intrinsic value of these digital tools.

Today, labor shortages and burnout represent a significant challenge for the healthcare sector. The Surgeon General recently wrote about the burnout crisis in medicine citing over half of the workforce exhibiting symptoms - all contributing to the expected shortfall of 124,000 physicians and 3.8 million nurses by 2030. AI-driven solutions represent a lifeline to our clinical workforce - offering the potential to remove administrative tasks, streamline workflows, and increase provider satisfaction.

New regulatory standards are further unlocking a previously siloed healthcare industry. Rules like the ONC Cures, CMS Interoperability Rules, and relaxed telehealth policies are allowing data to be accessed by others programmatically, and allowing new care models to emerge. Additionally, our country's policies are advancing around the use of AI algorithms - we have 520 FDA approved algorithms as devices, and recently selected a tech industry veteran to lead digital health for the FDA.

The culmination of these factors set the stage for change, and now with generative AI we have the tools to do so.

The Generative AI and Healthcare AI Startup Landscape

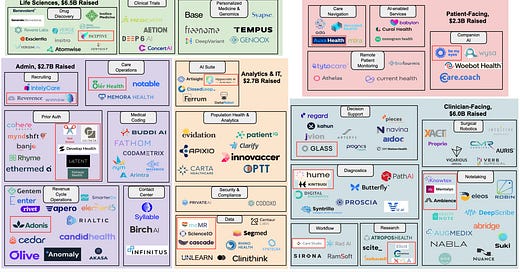

For this report, we have assembled a list of AI companies by sector, creating a market map to help founders and investors think through areas where generative AI may be quickly emerging in healthcare. This map includes 145 companies that have raised a total of $20B in funding and have 47,000 employees working under them. We also interviewed both established and emerging AI companies - particularly those leveraging the latest tools to enhance their capabilities – to get their thoughts on the space.

Considering the exciting and disruptive impact of this technology, both established and new businesses are attempting to integrate these new technologies to various degrees. Today, from the outside of these companies, it’s impossible to draw a perfect line between AI companies and generative AI companies. We acknowledge this lack of precise distinction, and for this reason, we've added a red box around companies who launched their product after 2020. These companies are likely incorporating the latest technologies into their foundational tech stack from the get-go.

Life Sciences ($6.5B Raised, 9 yr Median Age, 22 Companies)

“ConcertAI, as our name would imply, uses AI throughout its operations, including all classes of latest LLMs through to GPT-4 Generative AI. As a research-centric RWD company this involves the processing of unstructured data into machine readable forms. Today we are able to do so for 50% of the data we use, whereas two years ago it was less than 10%, and we expect this to be 75% within eighteen months. Classes of analyses and solutions that used to work iteratively or as a set of sequential steps can now can be approached as a simultaneous optimization and set of recommendations. The benefits realized to date and anticipated going forward are tremendous – where initial improvements are from 50% to 1 to 2 orders of magnitude.”

- Jeff Elton, CEO ConcertAI

The AI companies in the life sciences were the most mature market with the highest amount of funding (>$6B) and oldest median age (9 yrs) of all the categories we studied.

Drug Discovery

Drug discovery is a primary application of AI in life sciences, where companies concentrate on developing novel, life-saving drugs. Some examples include DeepMind's 3D protein docking simulations, Deep Genomics' genetic medicine discovery tools, and Inceptive Nucleics' RNASeq technology. Drug discovery represents one of the largest and mature market opportunities for generative AI, with total funding exceeding $3B, the most in any category we studied. We are already seeing companies like Google begin to step in with generative approaches, and are excited to see what creative ways generative AI is used in this space.

Personalized Medicine and Genomics

Another area of interest is personalized medicine and genomics, which encompasses companies that leverage AI to develop personalized medical solutions and advance genomics research. For instance, Freenome's multi-omics platform detects cancer through blood samples, while Genoox's analytic tools make genetic data more clinically useful. Opportunities for AI in this field include enhancing the accessibility and understanding of genomics information through natural language querying and AI-driven analysis.

Clinical Trials

Clinical trials are another domain where companies focus on optimizing processes by utilizing AI-powered tools and data analysis. Deep6AI's clinical data software, for example, accelerates patient recruitment for clinical trials. While companies like unlearn.AI are creating synthetic control arms for trials with simulated patients. Other AI applications in this space include improving clinical trial quality and efficiency, refining trial design, and targeting the right patient populations.

Patient-Facing ($2.3B Raised, 8.5 yr Median Age, 12 Companies)

“Generative AI and large language models open up a vast array of opportunities across our operations at Collective Health. Our team is particularly excited about their potential to automate time-consuming tasks, like producing health benefit plan documents - Summaries of Benefits Covered (SBCs) and Summary Plan Documents (SPDs). These complex documents require significant human effort to produce and check for errors. With AI, we can not only save time but also improve accuracy. Furthermore, this represents a larger shift in healthcare. By reducing the enormous volume of paperwork for patients, physicians, administrators, and insurance carriers, AI can eliminate significant waste in terms of time and expense. It's a promising future where AI becomes a cornerstone of efficient healthcare administration.” Ali Diab - CEO Collective Health

Patient-facing companies are the second highest median age to Life Sciences companies (8.5 years). This was an early entry point for AI solutions due to a lower barrier to entry for these companies to get started.

Remote Patient Monitoring

Remote Patient Monitoring (RPM) companies emphasize data-driven decision-making and personalized care to improve patient outcomes and reduce healthcare costs, with a focus on home-based care and monitoring. These companies tend to be capital intensive, with the largest median raised ($87M) in this category, likely due to needing physical devices. Examples include Current Health, which was acquired by Best Buy, and its suite of home monitoring devices, and Biofourmis with its smart sensors for hospital patients. Generative AI applications in this area include multi-modal generative AI for conversational and ambient data collection, such as monitoring healthcare professional visits or medication adherence, in order to enhance patient care and support.

Companion AI

Companion AI companies help individuals with specific health-related needs, for example, for mental health issues, Woebot and Wysa offer a supportive AI chatbot. This is an exciting space that has received lots of attention, especially due to the mental health crisis we are facing globally. We see a variety of applications here, such as an upgraded WebMD for general healthcare issues and triage, assistant for overburdened caregivers, and parenting for kids with developmental issues.

AI-enabled Services

Leveraging AI-first technologies, companies such as Curai and Babylon Health in primary care, and Monogram Health in specialized care, are revolutionizing patient triage and response times by owning the whole care stack. This sector is particularly thrilling due to the immense operational efficiency new ventures can achieve by embracing the productivity enhancements offered by generative AI.

Care & Benefits navigation

Care navigation apps, like Ada Health and Babylon Health, assist patients in better understanding their health and guide them to the appropriate care providers. Benefits Navigation companies, such as Navvi Health, Collective Health, Auxa, and Talktomira, focus on helping employees and patients navigate their healthcare benefits and options. However, these companies face challenges like overcoming vendor fatigue and budget constraints in the current economic climate. Interestingly, these companies have the largest amount of funding in this category and the lowest amount of median funding per company, which implies the category is more saturated and less capital intensive then other patient-facing categories. We’re excited to see how generative AI can streamline user experiences, interpret health information, and guide patients more holistically, potentially reducing readmissions and encouraging proactive care.

Clinician-Facing ($6.0B Raised, 7 yr Median Age, 49 Companies)

"In the world of medicine, doctors traditionally hone their pattern recognition skills through years of practice. However, the newer generation of large language models, with their unlimited computational capacity and access to petabytes of data, are poised to redefine this landscape. Outperforming humans in differential diagnosis and other cognitive tasks, AI has the potential to significantly enhance traditional medical practices." - Dereck Paul, CEO & Co-Founder of Glass Health

Clinician-facing companies recorded the second highest amount of funding for the categories in our report. This speaks to the significant interest and investment to build better tools to enable the provider experience.

Clinical Decision Support

Clinical decision support encompasses AI technologies that assist doctors in enhancing their clinical decision-making. Companies like Navina AI develop intuitive patient portraits from unstructured data while Glass AI is developing a next-generation AI notebook for doctors. We are particularly excited about how gen AI is being used in this space to simplify real-time patient data interpretation, streamline disparate data sources, and significantly improve clinician productivity. This space is expected to see rapid growth with the emergence of new companies, as AI augmentation proves more accessible than diagnostics, and improving clinician leverage can enhance care and add significant value in a supply-constrained environment with costly practitioners.

Robotic Surgery

Startups such as Intuitive Surgical and Verb Surgical are pioneering robotic surgery, enabling clinicians to perform minimally invasive surgeries more effectively. However, we are cautious about this space due to its capital-intensive nature, challenging fundraising environment, and the complexities of obtaining FDA approval. Furthermore, the risks of large language models hallucinating are very high in surgical situations.

Note-taking

Note-taking technology is perhaps the most developed space. New generation (Ambient, Abridge) and old generation (Suki, Nuance, Robin) note-taking technologies currently exist in this space, with the creation of scribe technology now requiring less effort, we anticipate competition driving scribe services to become highly specific and tailored to individual workflows. It would be exciting to see these products extend to code suggestions, as innovative teams can quickly adapt (Knowtex).

Diagnostics

Companies in diagnostics leverage AI to identify diseases more rapidly. These include companies like PathAI (pathology slides) and vocal biomarkers (Hume AI, Kintsugi), as well as early detection companies such as Syntrillo, Monogram, and Viz AI. We are interested in how new generative technologies can transform large, complex data sources into more digestible information. However, this area faces challenges in obtaining rigorous FDA approval, often requiring clinicians to retain judgment ability and act more as decision support tools or analytical/alerting aids.

Workflow Automation

Workflow automation includes companies like Rad AI, RamSoft, and Sirona that augment existing clinician workflows to enhance their productivity dramatically. We are excited to observe this space acquire much more traction as more companies flock to this space for other routine and multimodality tasks like medical records summarization.

Research

We are curious to see how information retrieval evolves. Newer companies are displacing outdated ones in this space. Examples include Consensus, which helps people understand scientific data, and Inpharmd, which provides summarized databases of reputable medical studies. We expect this space to grow and hypothesize that verticalized solutions tailored for specific use cases will emerge due to the low barrier to entry.

Admin ($2.7B Raised, 5 yr Median Age, 43 Companies)

“Healthcare represents a multifaceted ecosystem where each stakeholder holds unique needs and nuances. The sheer volume of administrative systems and tools can be daunting. Generative AI has the potential to transform administrative burdens into streamlined processes, bringing efficiency and precision to the forefront. It also serves as a catalyst for proactive healthcare management while fostering enhanced communication across all stakeholders. Essentially, Generative AI has the potential to be the bridge that connects the complex dots in healthcare administration.” - Jia Li, Co-founder and Chairperson of HealthUnity Corporation

This category encompasses all administrative automation companies – this category is the youngest (lowest median age), speaking to a higher number of more innovative, newer companies that are coming in to tackle this space.

Revenue Cycle Operations

Revenue cycle operations represent companies that help healthcare providers improve the amount they receive from insurance companies after submitting a claim. This is the largest space by far in the Admin category and a market with many players. Long-time players like AKASA and Olive AI exist and newer technology offerings, such as Adonis (emphasizing better UI/UX and billing OS) and Candid Health (developing an API-like billing solution), are emerging. Google has also recently entered the claims processing space with its Claims Acceleration Suite. This sector represents a large Total Addressable Market (TAM) but poses challenges for new startups in gaining distribution and trust. We're interested in seeing how GPT-related tools can be used to uplevel existing staff (billing teams) and track the rapidly changing rules set by payers and analyze claims data effectively.

Medical Coding

Medical coding involves the process of helping convert an encounter to codes that are recognized payers for billing reimbursement purposes. Companies like Fathom and nym.health are examples in this space. We anticipate this area to have lots of bundling opportunities, either into the Revenue Cycle Operations space or into the AI-notetaking space (e.g. helping providers convert notes into claims with codes).

Supply Chain

Hospitals and clinics spend an estimated $765 billion a year to maintain a diverse inventory to treat patients. Companies like Tomorrow Health and Gather Health address this issue. Although no AI companies have emerged in this space to our knowledge, it represents a significant need as care transitions to the home setting. We're curious to see if any AI applications will arise in this area.

Care Operations Automation

Notable Health and Artera use AI to automate and digitize patient intake, scheduling, authorization, and more on a single platform. Oler Health is another company in this space, summarizing large referral PDFs into actionable insights for faster patient care.

Contact Centers

Companies like BirchAI are automating call centers and managing greater patient inbound calls for tasks like prior authorizations or claim status checks. We're interested in seeing applications of technology similar to Gong in this space, helping analyze performance and improve over time.

Recruiting

With the large shortage of healthcare workers, AI-based recruiting tools (WinnowHealth, ReverenceCare, IntelyCare) are focusing on increasing marketplace liquidity. We're excited about how these companies can uplevel and incentivize their workforce using AI technologies. Although the application of generative AI systems isn't as clear to us, this space is crucial to addressing a core issue in healthcare.

Prior Authorization

This active space has numerous companies addressing the pain points of prior authorization, a process where clinicians or pharmacies must obtain special approval for equipment, drugs, or surgeries (often expensive). Companies in this sector range from long-standing firms like Rhyme to newer upstarts like Latent Health. Even Doximity has entered the field, offering a chat-GPT tool to help draft appeal letters. Many of these companies target specialty pharmacy due to the growing trend of these drugs and their high costs. With incumbents and innovators competing against each other, as well as AI/software distributors who may choose to upsell, this space is interesting to watch. AI is particularly beneficial here as it can dynamically track rule changes.

Analytics & IT ($2.5B Raised, 6 yr Median Age, 19 Companies)

“Making healthcare data usable is a three mile race: 1) where is my data/are there pipes to transport it 2) how do I clean this data, and 3) how do I work with this data to solve a problem at point of care. All of healthcare has been stuck working on #1 for the last decade and we are in striking distance of having it solved. Generative models allow us to rapidly solve the last two problems without the need for another decade of legislative and standardization work.” - Will Manidis, CEO & Founder of Science IO

AI is nothing without data, and generative AI will change this landscape as analytic tools that were traditionally difficult to parse will now be made more accessible to non-technical individuals.

Data

A wide variety of companies fit into this category. Companies like ScienceIO focus on enriching these datasets by identifying patient health information and medical terminology, while Centaur Labs assists in labeling those datasets for AI. The shift to foundational models and few-shot learning will be interesting to observe, as it could impact the importance of large, fine-tuned datasets that previous business models relied on. We are excited for healthcare specific data tooling that will help companies leverage these new technologies.

Security & Compliance

We were surprised to find relatively few companies in this space, given how important both security and compliance are for healthcare organizations. Codoxo AI Compliance focuses on alerting, whereas Syntegra offers security and compliance solutions. The potential for LLMs to synthesize complex regulatory data into APIs makes this an intriguing area for innovation, as not many companies have been built in this space.

Population Health & Analytics

Companies like Clarify Health and Innovaccer play significant roles in population health management. Utilizing generative AI to make population health data more understandable and easily queried could be highly valuable as companies try to identify patients and the opportunities to intervene and provide better care. This could potentially render large, complex product suites obsolete or lead to faster commoditization, which we believe is beneficial for the ecosystem. As the shift to Value-Based Care (VBC) occurs, we're interested in seeing what companies will develop to make this transition more efficient, particularly in analyzing claims data.

AI Suites

Companies like ClosedLoop, Ferrum, Artisight, offer a suite of AI tools that help identify implementation opportunities and drive cost savings, often assisting in deploying the models themselves. These companies, with their existing distribution channels, are well-positioned to quickly add and deploy new tools. Meanwhile, new players are emerging like Hippocratic AI. It will be exciting to see if additional competitors emerge as AI adoption accelerates and healthcare companies seek to incorporate it.

Challenges and Opportunities for Startups

“Several AI/ML-related tools have already navigated the regulatory landscape or penetrated the market deeply. However, it remains uncertain whether these companies, based on their prior experience, will transition towards generalized AI. It's worth examining whether their substantial technological debt and large-scale investments might hinder their ability to adapt swiftly enough.” - Andrew Trister, Deputy Director of Global Health & AI at the Bill and Melinda Gates Foundation

Generative AI has created a leapfrog moment, as existing technology becomes much easier to build and data moats are eroded with algorithms that require less data. We’ve separated market opportunities by technologically simple vs. technologically complex generative AI use cases, and market maturity (signs of early adoption, vs. visionary stage) . This is by no means definitive, but hopefully can start the discussion with the community on where we should all focus and spend time. The utility of generative AI is abundantly illustrated in the below graph, but it’ll be important to think through the challenges and opportunities that emerging startups will face in order to win in this space.

Innovator Challenges: Distribution is Key and Incumbents are Ahead

The key to winning in healthcare is distribution, which is often the most challenging obstacle startups will face. Three factors stand in the way for new startups: slow sales cycles, the growing ease of building AI solutions, and the importance of relationships and trust.

Slow sales cycle

Extended sales cycles pose a significant challenge, often taking 12-24 months to finalize contracts with larger healthcare organizations. This is typically due to the stringent security requirements in healthcare, the substantial switching costs associated with changing systems, and the need for reliable, trustworthy systems given their direct interaction with patients.

The process often entails obtaining stakeholder approval, meeting rigorous data security standards, and demonstrating a return on investment (ROI) through smaller pilot programs. Consequently, the initial effort or "activation energy" required is quite high for health systems. For this reason, these organizations frequently want to see substantial value from the product before embarking on the sales process, another obstacle for startups seeking entry.

Ease of implementing AI & future regulation

In the past, initiating an AI solution required a large pool of experts, but now, thanks to new-generation foundational models, AI implementation has become as straightforward as a single API call. Major players like OpenAI and Google provide these models that can efficiently perform "few-shot learning" using minimal data points.

As these models grow in popularity due to their efficiency and accuracy, new startups face the challenge of maintaining their technology defensibility in the industry. They have several strategies at their disposal: refining proprietary data for enhanced model performance, applying prompt engineering to customize models for specific tasks, or creating tailor-made AI models from scratch. Although the latter is more time-intensive, it potentially results in more bespoke and precise solutions. However, the ultimate value and defensibility these strategies will offer and whether existing industry leaders can replicate similar technology remains something to watch closely.

On the horizon, new innovators face imminent hurdles as regulators draft rules governing generative AI, and established players strive to protect their technological advances. Significant activity is already underway. For instance, on May 16, OpenAI CEO, Sam Altman, spoke with congress about regulation, and we speculate that larger incumbents may collaborate with regulators to their business advantage. On the flip side, the European Union is drafting additional rules around generativeAI – in these situations incumbents may turn away from these markets which will provide opportunities for startups.

Trust and relationships

A significant trust gap exists in AI, posing a critical challenge. Due to worries about explainability, potential bias, and the appropriateness of local resources, healthcare professionals show hesitancy in utilizing generative AI for care decisions. Past overpromises from technology, like IBM Watson from a decade ago, have heightened this caution in the healthcare industry.

For these reasons, providers will typically turn to healthcare incumbents first for solutions. Consider industry giant Epic, which owns 33% of hospital market share. Epic's recent partnership with Microsoft and initiatives around patient-messaging demonstrate their rapid expansion into the gen AI health system landscape, which will make it difficult for startups to enter the space.

Companies with existing relationships and products in the market will find it easier to expand their existing offerings than early startups hoping to provide point solutions. Successful startups will find creative methods to navigate these challenges and find explosive go-to-market strategies.

Innovator Opportunities: New markets, 10x opportunities, and strategic partnerships

Given these challenges, where should people be looking to build in this exciting space? We believe healthcare gen AI startups will find success in three areas: new markets, 10x opportunities, and strategic partnerships.

New markets: Entrepreneurs who are agile, innovative, and willing to delve into new markets can often outpace incumbent players in capturing these new customers. For example, during COVID-19 there were large shifts in the digital health market that were captured by startups. Companies built around decentralized clinical trials, covid-testing and tele-therapy were able to grow rapidly and beat out the incumbents to scale in these new market opportunities. As new markets emerge, and healthcare laws continue to change, startups should be prepared to move quickly at these opportunities.

10x opportunities: Startups are better equipped than larger organizations when technological changes allow for 10x improvements in existing products and solutions. Big companies can usually handle small improvements in technology and adjust their business accordingly; however, with a 10x change, incumbents are hindered by slow decision making processes, incorrect staffing, competing stakeholder interests, and outdated business models. Startups in the healthcare generative AI space should focus on areas that allow for massive improvements over the status quo that will attract customers to switch products and leaving incumbents behind.

Strategic partnerships: While a startup might not have distribution on its own, one way we have seen startups scale and break out is through strategic partners and new platforms. As generative AI is one of the most exciting technology advancements in years, large companies are now more open to partner with newer startups. Simply look at how fast Epic was willing to announce a partnership with Microsoft and OpenAI. Another example is Veeva Systems, which originated as a spinoff from Salesforce and ultimately became one of the most valuable digital health companies in the world. Generative AI startups in healthcare that navigate strategic partnerships successfully will have an improved chance of breaking out and finding explosive growth.

Sectors to keep a close eye on

AI-enabled note-taking - A sector worth learning from and keeping a close eye on is AI-driven note-taking, which is far along its developmental path. Just six months ago, generating notes required an elite AI team, often aided by human intervention. Today, conversations can be transcribed and notes generated quickly via a few API calls. Competition in the note-taking domain is already fierce. Incumbent companies like Epic, Amazon, Microsoft/Nuance, and Google are announcing partnerships for their healthcare AI note-taking applications. Mature startups like Robin and Suki, which have existed for about six years, offer products with a reasonable market adoption rate. More recent entrants like Abridge or Ambience have emerged in the last couple years focusing on leveraging newer generative AI techniques.

Given the intense competition, we foresee a significant reduction in the cost of note-taking software over the next two years. We also anticipate companies carving out market niches and the rise of workflow-specific AI scribes. Will established companies manage to expand their existing contracts with enough health systems to block startups? Will the newer generation of startups unlock explosive growth as clinicians purchase their more cost-effective, AI-enabled scribes? We are excited to continue watching this space as we think many learnings here will be applied to other burgeoning categories of generative AI products.

The return of tech-enabled services? Could the advent of advanced generative AI software solutions herald a resurgence of tech-enabled services?

Historically, these providers have struggled with narrow margins, appearing more akin to traditional service businesses than tech enterprises from a business metrics perspective. Now, however, they could leverage these novel AI tools to boost operational efficiency and capacity of their clinical workforce, achieving previously unattainable levels of efficiency. Just look at Carbon Healths recent announcement about building their own AI tools for note-taking. Their Fee-For-Service (FFS) payments or Per Member Per Month (PMPM) payments from payers or employers will likely remain the same in the near term, allowing them to pocket the efficiency gains. With the technical barrier to build these tools dropping by the day, we could see tech-enabled services players reach a new potential.

What comes next

We are in the earliest innings of the world turning its attention to the abilities, potential, and complications of using LLMs on every task imaginable. In healthcare, while there are many issues to overcome, we believe LLMs have the potential to have transformational positive impacts for the lives of patients and providers.

At GSR Ventures and Maverick Ventures, we want to partner with founders using these new tools to improve human health, and work with the existing healthcare giants who are ready to learn about and incorporate these new technologies. Please reach out to us if you are building in or want to learn more about generative AI and healthcare.

Benjamin Lee, Sherman Leung, and Andrew Trister for reviewing this work. We’d also like to thank the entrepreneurs we interviewed—Dereck Paul @Glass AI, Ram Swaminathan @Buddi AI, Gabriel Jones @Proprio, David Mou @Cerebral, Sean Raj @SimonMed Imaging, Will Manidis @Science IO, Jeff Elton @ConcertAI, Jia Li @HealthUnity Corporation, Ali Diab @Collective Health—for spending their time to provide their invaluable insights, support, and contributions to this analysis.

Justin thanks for this detailed and comprehensive analysis!! Great work

Guys--I like the piece but that big chart in the middle is a mess. Seems like half those sectors aren't really using AI and half are AI based. Not sure what is the difference between the "old" ones and the red boxes.